Peerless Tips About How To Handle Debt Collection

Steps to paying off debt:

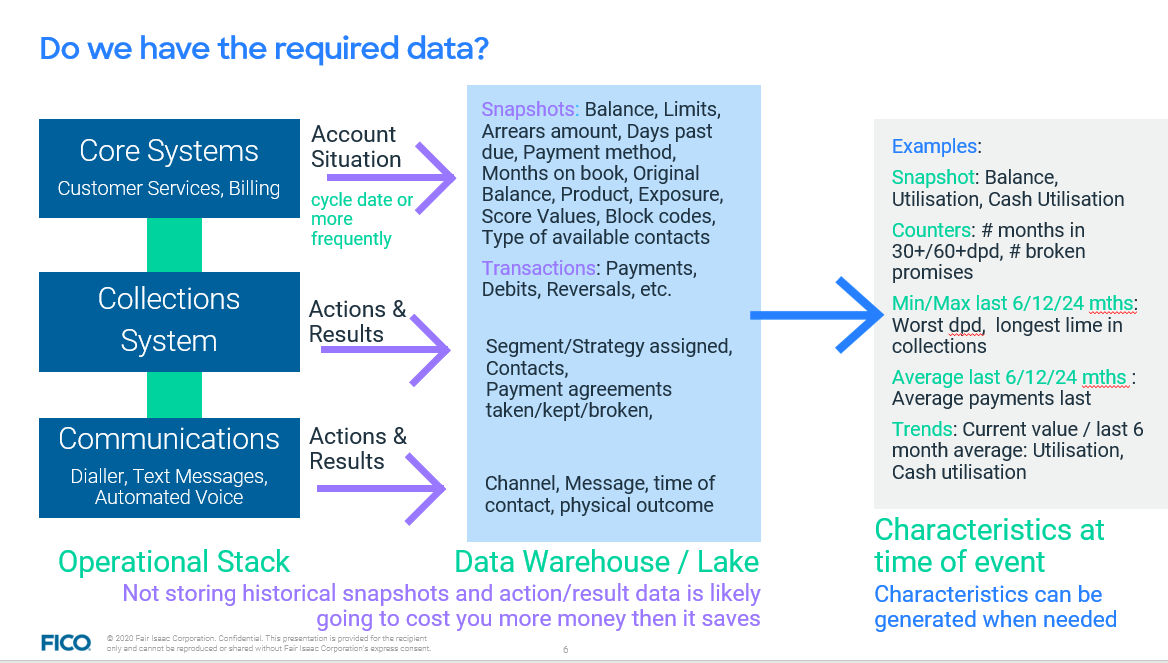

How to handle debt collection. The following are the steps to deal with debt collections on your own: In most cases, your lender has an internal debt collection department that it will go to first. Now that you understand your rights and how to watch out for potential scams, let's talk about how to deal with debt collector when they start.

First, if they hand over the work of collection to these agencies based on a certain percentage of commission. It is also possible that you already paid off the debt, they have the wrong information in the file, or the statute of limitations expired. How to deal with debt collectors.

Once you receive the validation letter from wells fargo , review it to verify all information is correct and up to date. Here are 10 tips for getting a bill. The entity that owns the debt is.

How to handle debt collectors apply for a personal loan today. Do not ignore the summons that you received from the debt collection law firm. The less they know about you, the better.

Best credit cards for bad credit. Developing a plan research your debt and debt collector. Politely tell them it’s your policy to deal.

You must respond to the lawsuit to defend yourself. The good news is that you may be able to work with bill collectors so they can close the account and you can both get on with your lives. Once contacted, you have 30 days to validate the debt, so act quickly.