Heartwarming Info About How To Reduce Apr On Credit Cards

The only way to eliminate credit card interest entirely is to pay your balance in full every month.

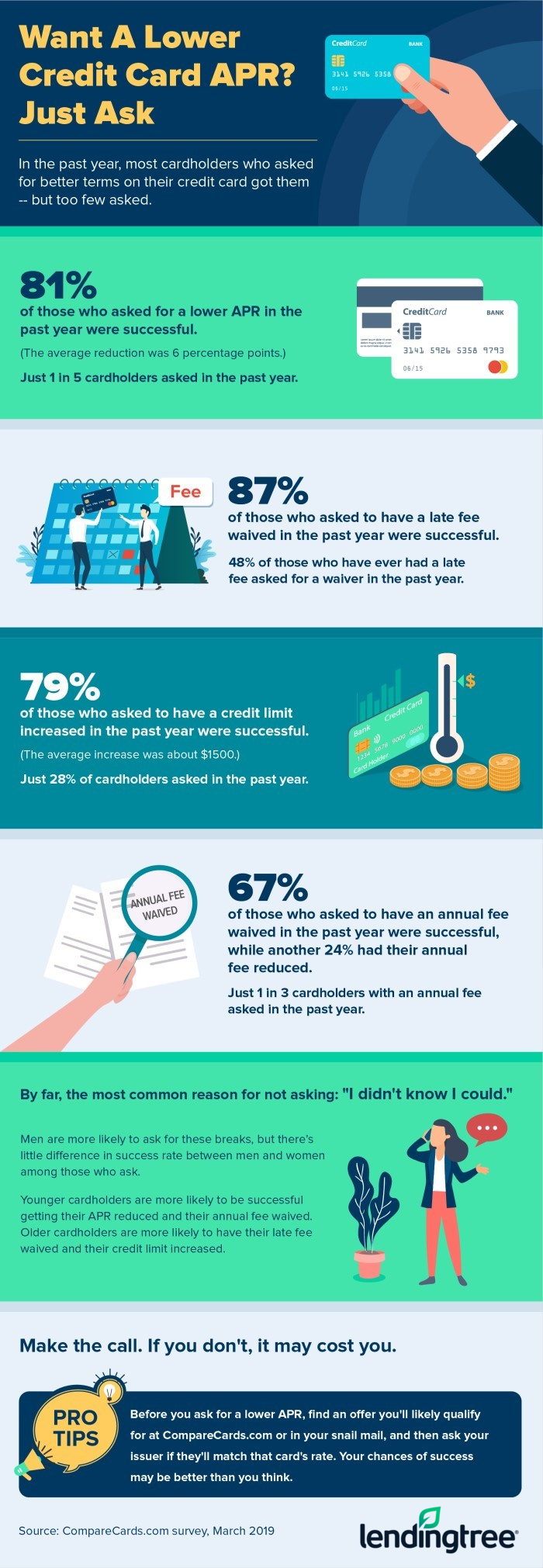

How to reduce apr on credit cards. New york ( mainstreet) — credit card interest rates are climbing high again. Here are some ways to reduce your credit card interest charges: You need to talk with someone who can lower your apr and waive the annual fee.

Ask them to transfer the call to a supervisor. Ad get a card with 0% apr until 2024. Choose a debt payoff strategy to lower your balance and your interest charges.

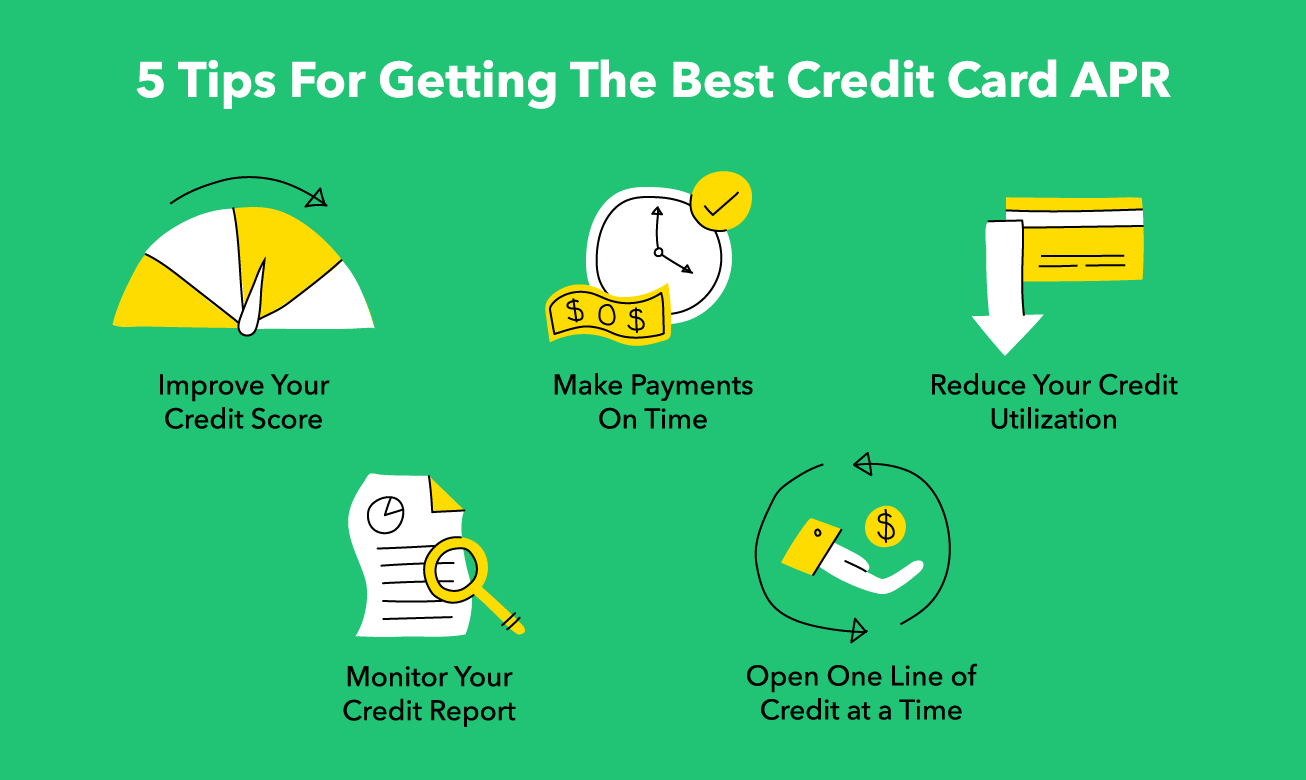

Your credit card company won't lower your apr just because you've been taking. You’ll either qualify for a rate reduction on an existing account, or on a new account with a lower rate. Banks make this decision based on their product lineup:

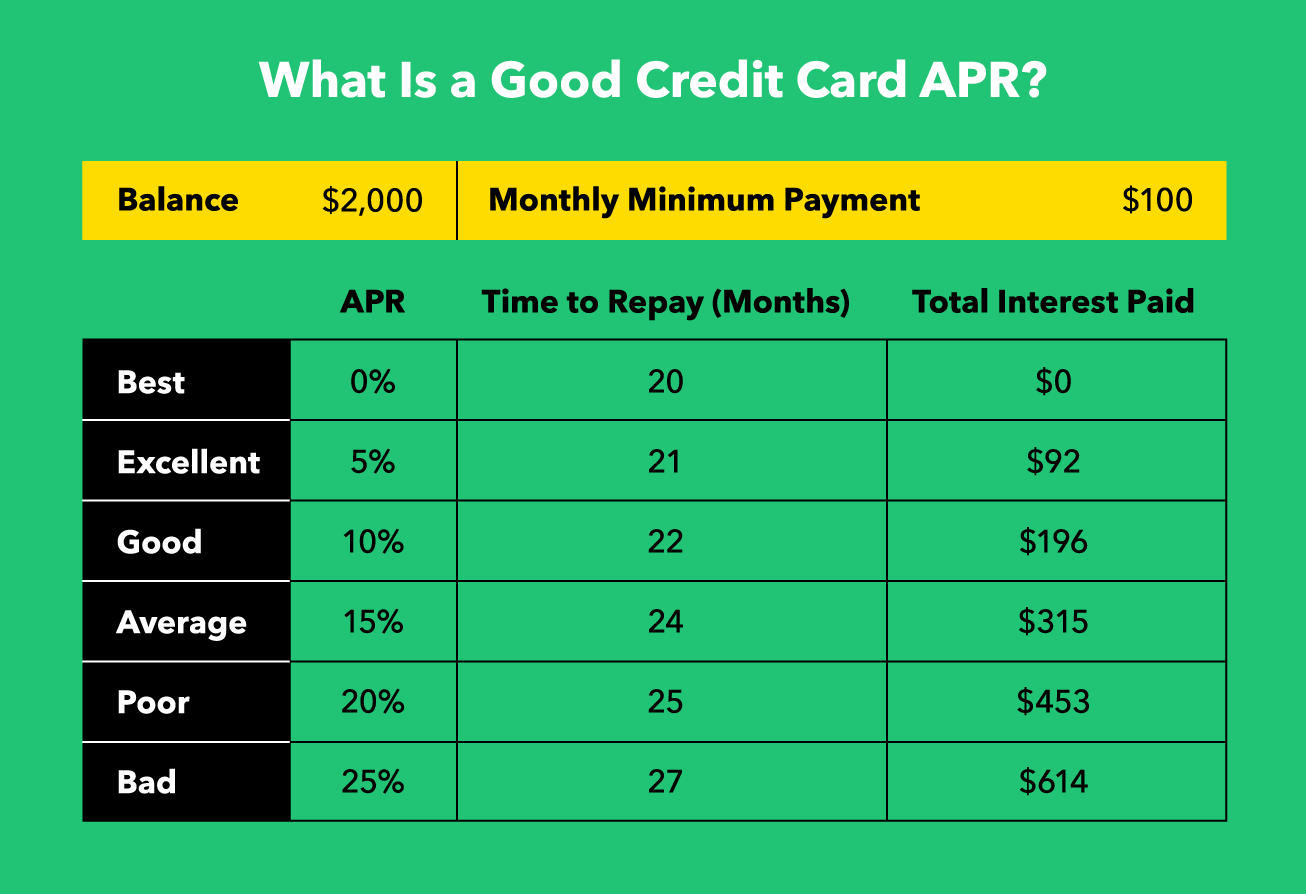

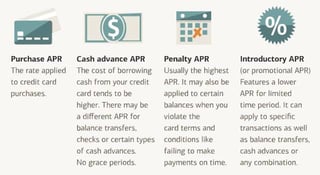

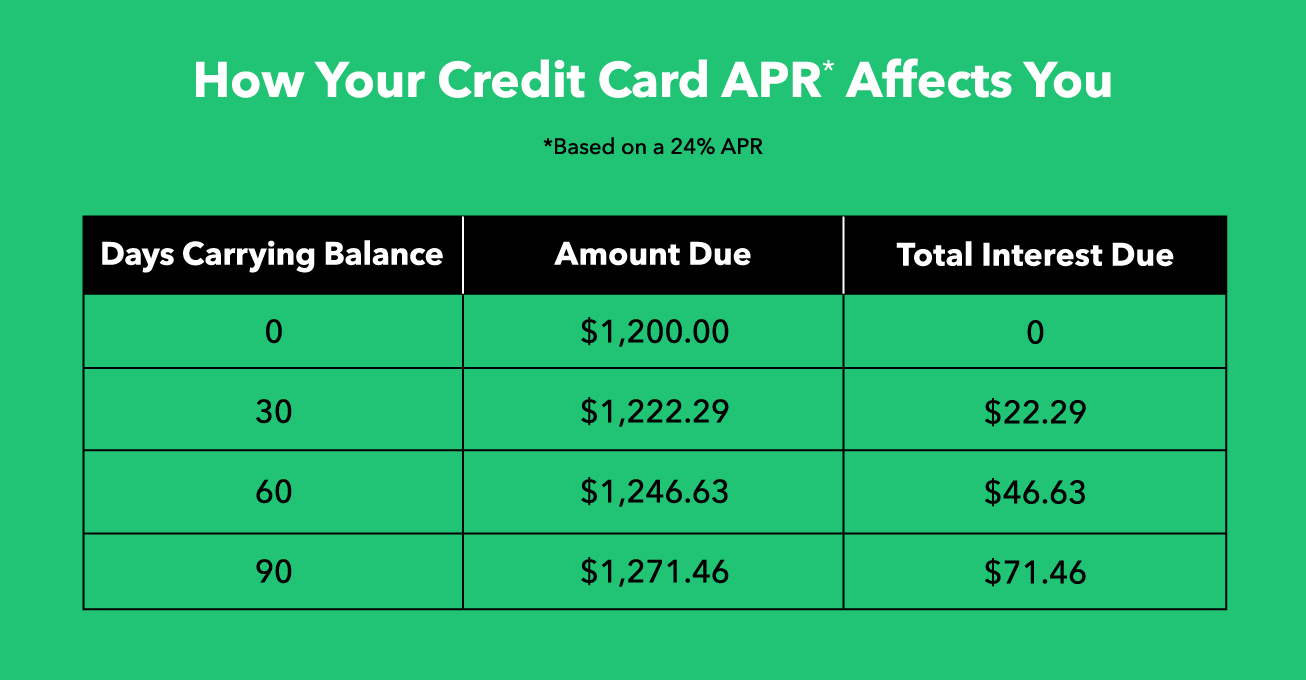

One way to reduce your interest rates is by paying off your debt with the lowest amount of interest. Our experts found the best credit card offers for you. Penalty aprs might kick in if you miss payments, go over your credit limit, or make a credit card payment that is returned for some reason.

Prepare a strong case for why you. Transfer your balance and save with the citi® diamond preferred® card. Call the number on the back of your credit card and request a rate reduction.

Ad get a card with 0% apr until 2024. Once you eliminate the first debt, move on to the debt with the next highest apr. You can possibly lower your credit card's interest rate by doing research, contacting your card issuer and requesting a lower apr.

/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)